Chapter 10

Tokenization & DAOs

One of the associated side effects of increasing popularity of blockchain protocols and dapps has been tokenization. This chapter aims to explore how the concept of tokenization evolved over time and highlight some of the most notable manifestations of different concepts in tokenization. ICOs, or Initial Coin Offerings, caused a great deal of hype in the cryptocurrency space. As interest in ICOs to large extent has already evaporated, tokenization keeps manifesting in different forms and shapes. STOs (Security Token Offerings) and IEOs (Initial Exchange Offerings) emerged as continuation of this trend but with some notable differences. In parallel, another strong trend emerged in the form of NFTs (Non-fungible tokens) as a standard for recording unique assets in the blockchain networks. Tokenization inevitably touches the field of finance as well. This gets reflected in multiple ways not only the traditional finance but in a brand new sector often referred to as Decentralized or Open Finance. In this chapter we explore tokenization in some of its coarse forms of ICOs, NFTs, and DAOs. The more nuanced and detailed implications of this trend and its impact on the financial world is analyzed in the next chapter where Open Finance is discussed.

Initial Coin Offerings — ICOs

The emergence of blockchains brought an interesting phenomenon to the world of open-source software. By introducing native protocol tokens, the team and community developing the protocol essentially created a monetization mechanism of their development effort. The more utility their protocol generates for the users the more demanded its token will be. This has been especially true for the “fat” protocol tokens where every transaction on a given protocol incurs protocol-level transaction fees distributed to the miners or validators of the protocol. As the network traffic rises with increasing adoption, naturally, demand for the token rises too.ICOs, therefore appeared as a way for investors who believe in the utility of a protocol to partake in its success, or failure, by buying protocol tokens before the network even launched. Receiving a significant amount of money upfront, with no product, and without undergoing scrutinized processes of venture capital funding , proved a tempting option for many product teams. Moreover, as the whole process was conducted outside of traditional finance, little to no regulation applied, or more precisely have been followed. The purported democratization of VC investing was available to the public with no restrictions whatsoever. This Wild West-like experience provided many retail hobby investors with powerful learning lessons, more so than with profit. As we discuss further, what was a great deal for founders, usually did not turn out to be such a great deal for investors.

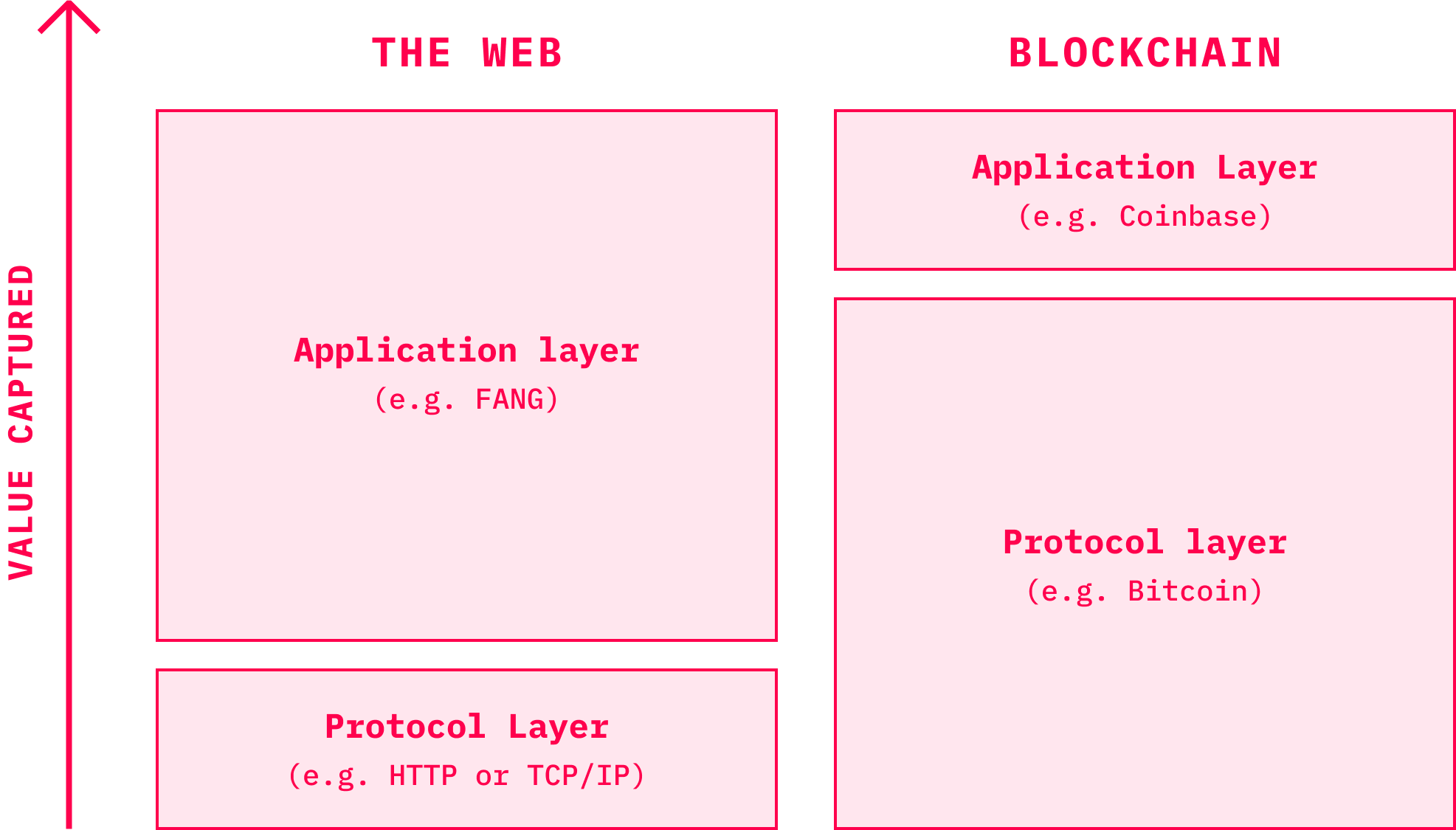

The term ICO was created by drawing an analogy with IPO (Initial Public Offering), the stock market event during which shares of a company are sold to institutional as well as retail investors for the first time. Despite their shared similarities, ICOs do differ in a number of aspects. Tokens often came with very limited rights for the investors, and most of the time entitled them to neither participation in cash flow, nor dividends or ownership rights.Yet, in some cases ICOs do make sense for both parties involved — developers as well as investors. ICOs, especially when it comes to tokenization of open-source protocols have offered a viable funding mechanism that is likely to sustain, at least to some extent, into the future. While the early days of the Internet were characterized by lack of funding for the foundational components of the world wide web, due to tokenization this is not the case with the blockchain-based protocols. Protocols such as HTTP or TCP/IP, despite being the crucial building blocks of the Internet infrastructure, were not particularly good in capturing value even though they have been heavily utilized by billions of users. Most of the economic value got captured by the applications built on top of them. The opposite seems to be true for blockchain protocols. At least in their first decade, they seem to bring an interesting paradigm shift.

The fat protocol investment thesis was made popular by Joel Monegro of Union Square Ventures in 2016, and has been intensively discussed in the VC community. A glimpse at a cryptocurrency market capitalization chart suggests that fat protocol thesis still holds as the majority of the TOP 20 coins are indeed “fat” protocols. The evidence of the past empirical data do not necessarily need to stay valid for the future, though. As the past decade was heavily focused on development of the underlying protocols, the second decade will be much more about building the application layer, which blended with off-chain techniques may be even more successful in value capture. Mastercoin was the first project in the history that conducted an Initial Coin Offering in 2013. In our conversation, J.R Willet, the lead developer of the project reminisced the struggle that led him to come up with the idea:

Yeah, Mastercoin was the first, what they call an initial coin offering that ever happened. Basically, it happened because I was too lazy and too busy to go around trying to raise venture capital in the traditional way. So instead I was looking for a shortcut.The problem also was with raising venture capital was, I was pretty sure, that most of the venture capitalists viewed cryptocurrencies at that time as something kind of out there and most of them didn't seem to understand it. Within a few years they started getting really into it, but at that time I thought the only people that understood what I was doing were the people on the Bitcoin forum. Those people seemed to get it. And I realized that my best chance of raising funds to work on my project was to raise it from the people on the Bitcoin forum.And so that initial coin offering idea was designed to solve that problem: how do I raise money from my friends on the Bitcoin forum instead of going to Silicon Valley and trying to convince somebody what cryptocurrency is and that more advanced cryptocurrencies are a good idea when they are not even sold on Bitcoin.

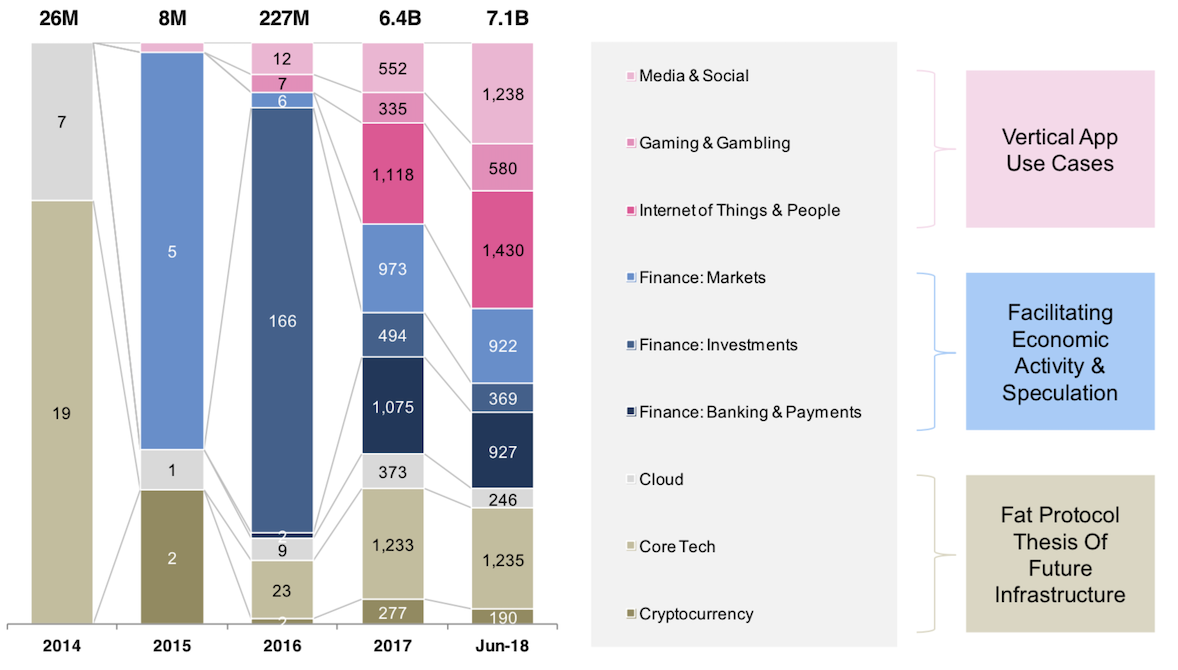

Little did J.R. Willet know what frenzy he set in motion by raising 5000 BTC, or an equivalent of a half million dollars at the time. Just a handful of projects followed the suit in the following two years, including Ethereum raising over $18 million. By 2016, the number of projects attempting to raise the funds for development through ICOs started to rise more significantly, and the full-fledged craziness arrived in 2017 with Bitcoin passing the mythical threshold of $1000 per coin, once again.Notably, the ICO fever brought some interesting trends. The rise of ICOs led to proportional rise in so-called utility (or app) tokens that were not necessarily needed for usage of a protocol or app, but gave the app developers an additional source of revenue. Utility tokens came with a dilemma though. Designing an app ecosystem with an artificial token represented quite a friction for onboarding of the new users. But the promise of easy-to-grab money stimulated creativity of developers, and incentivized them to come up with all kinds of design patterns that would supposedly cause the token price to rise in value proportionally with the app usage. Token economics — or “Tokenomics” quickly became the new buzzword that many used in justification of their outraged valuations.

Source: Autonomous Next

Amongst all the buzz, a very few projects proved their claims and assumption to be true. The experimental nature of the ICO space did beget some valid economic models worth exploring, though. Some of the tokens have come up with what appears to be value-accruing properties. They typically coupled increasing demand for the token with its decreasing supply through embedding artificial shortage mechanisms — like burning or buybacks. While some of the projects like Binance or MakerDAO burn their token supply based on a predetermined key, some others perform ad-hoc burns. Stellar Development Foundation liquidated in this manner over 55 billions of their tokens — worth almost $5 billion — in the fall 2019.Tokens with governance rights have also been quite successful in maintaining their value proposition, given that the underlying protocol was really useful. Decred or MakerDAO are good examples here. While it is too soon to say the same about Compound, the first months after its governance token launch seemed to suggest the similar trend.While burning was supposed to mimic the effect of profit sharing with the token holders, some of the projects took it even further and offered straight forward payouts. For instance, the TaaS fund paid out a share of the profit from their investing activities in several quarters after their ICO in early 2017. A practice like this just added fuel to the fire over an already grey legal area ICOs had existed in, and urged regulators to step in. This further accelerated efforts to conduct similar crowdfunding activities in compliance with at least some of the national regulatory regimes, and thus led to emergence of STOs.

The large amount of pump-and-dump schemes that let the lucky investors capitalize on short-term investments with little fundamentals once again reinforced the “FOMO” (Fear of missing out) mentality that prevailed in the crypto space largely thanks to the influx of new users. The frenzy went on until early 2018. A mere rumour of an established company preparing to do an ICO would cause a spike in its stock price, and wanna-be token issuers were trying their best to get high-profile advisors for their project, or at least have a picture with them on the website. Those who missed out on the early Bitcoin train wanted to make sure to catch the next Bitcoin. Such a thing never came even though quite a number of coins were able to yield insane profits of hundreds of percent.

Unfortunately, the abundance of get-rich-quick joyriders that plagued the space distorted focus of the users, media as well as regulators and eclipsed the overarching vision and mission that cryptocurrencies embodied — to fundamentally transform the financial system. This transformative power, nonetheless, spills over to other areas of our society as shown further in this chapter as well as the following ones.Looking at the ICO numbers, it is understandable that people’s attention shifted from the underlying technology to money-making machinery it enabled. All of the largest ICOs to date happened throughout 2017 and 2018:1. EOS — $4,2B2. Telegram — $1,7B3. Petro — $735M4. TaTaTu — $575M5. Dragon — $320M6. Hdac — $258M7. Filecoin — $257M8. Tezos — $232M9. Sirin Labs $158M10. Bancor — $153M

ICOs gave the world some unbelievable unicorns not only in terms of the sheer size of the amount of capital the projects were able to raise but also in the timespan over which they did it. Some of the most hyped ICOs were able to fill their cash tank in a matter of minutes while the privacy-browser Brave needed just bare two Ethereum blocks, or roughly 30 seconds. A billion of BAT tokens worth $35 million got sold to 130 hungry investors. Some of them were even willing to pay a hefty transaction fee of $6,000 to ensure their transaction ends up in the block. It sure paid off as the token price rose merely a few days after the token sale by 600%. The craziness of the ICO phenomenon got mocked by the “UselessEthereumToken”. A single person project promising nothing but buying electronics for the author from the money raised. Even this fictitious calling appealed to some, and the crypto folk responded, by contributing over 300 ethers worth over $60,000.

As an increasing number of projects successfully raised millions, even more teams started to look at ICOs as a viable capital raising option. As mentioned, an excess of easily accessible capital in the space inevitably lured in countless scams. The most infamous examples are arguably OneCoin and Bitconnect that managed to conduct multi-billion operations for quite some time. While enforcement agencies have actively persecuted some of the ponzi schemes, a good chunk of them managed to exit their deceitful projects with no repercussions.

In the meanwhile quite a few of the honest projects have been subjected to SEC (Security Exchange Commission) persecution. The omnipresent dispute over which cryptocurrencies are securities has yielded many victims and curtailed the progress of the whole ICO space. While the US regulators have been trying to provide answers and guidance around which tokens are considered securities, this guidance is based on applying over a half-century old definitions found in the Howey Test, or the Securities Act of 1934, they failed to comprehend the novel layers of complexity brought by crypto assets.To be fair, the fact that crypto assets may share a lot of similarities in terms of the underlying infrastructure, smart contract standards, or even usage patterns, and still be classified differently does not make it easier. On the other hand, the legal challenges they carry are a great opportunity to amend how we think about and classify assets in general. The ambiguity of definitions and usage of cryptoassets suggests we need to rethink their categorization, and that old tools we used before computers existed may not be relevant anymore. The lessons learned here go beyond the regulation of cryptocurrencies though. The pace at which technological innovations advance is far beyond what any regulators are capable to keep up with. It’s time to acknowledge it, and act accordingly. Self-regulating capabilities of tech communities can be hardly matched by efforts of enforcement agencies that mostly just stifle the good guys that need to beg for permission to innovate, while the bad guys fully enjoy all the perks of the permissionless systems and cheat the system anyway.

Some of the most heated debates in the ICO era was sparked over the token sale of a Canadian messaging company Kik that raised nearly $100 million by selling their Kin tokens which the SEC considered to be violations of the US securities laws through failing to register its public and private offerings with the SEC. While at the time of writing, there has not been a final ruling in this case, Kik strongly refuted SEC’s claims, stating the Kin is a currency, and even created DefendCrypto.org initiative to fund legal initiatives that impact the crypto industry. The initiative gained support not only from many individuals but companies too.

While it seems quite the stretch to argue that their investors, nor anybody in the ICO space for that matter, did not expect any profit from their investment, which is one of the criteria of the Howey Test, it may be worth to reconsider if such an abstract aspect as one’s “expectation” qualifies to be taken into account for a financial guideline in the first place.The conclusion in the case should come shortly after the most recent ruling in the contentious $1,7 billion offering of another messaging app Telegram. In that ruling Telegram’s planned distribution of tokens was found violating the Securities Act. The court ruled in favor of SEC’s preliminary injunction that prevents Telegram from distributing its tokens for the foreseeable future neither in the US nor anywhere in the world. In response to the ruling, Telegram announced discontinuation of their planned blockchain release while partially refunding investors. This is another example of Innovation stifled by compliance. The story we see increasingly more in today’s world of complex technologies forced to follow out of date rules from the old era. Yet, in the case of Telegram there is a community-driven effort to continue this project at Freeton.org

IEOs & STOs

Over time, ICOs have fallen out of a favour of investors and the whole market cooled down. While in 2018 the amount raised by ICOs reached almost $8 billion according to Icodata.io, the following year it was merely modest $370 million. However, this number does not account for the money raise via ICO successor — IEOs, or Initial Exchange Offerings. IEOs emerged as arguably improved version of ICOs with the main difference being that they were conducted via exchanges — also known as launchpads — that took care of most of the processes. According to CoinMarketCap, at least 250 projects raised this way cumulatively over $1,7 billion in 2019 alone, and the vast majority of them came from USA, Estonia, Singapore, the UK and South Korea. The data suggests some of them even yielded very decent profits for their investors, especially those launched via Binance. Most of the IEOs were conducted through cryptocurrency exchanges such as LaToken and Probit.Nonetheless, IEOs have suffered from similar symptoms as ICOs. They are certainly a good deal for exchanges that attract new traders to their platform and increase their trading volume, and thus their revenue, their usefulness for startups is questionable. Even though most of the launchpads implemented strict rules limiting the number of investors or the amount invested per investor, the startups in question often raised money while having no clear roadmaps, and focusing on market-making instead of their product.

For many, Security Token Offerings came with the promise of fixing the downsides of ICOs as the subject of sale is tokenized share in a company, and thus something that should not be prone to speculation and volatility we witnessed in the ICO arena. Some of the purported benefits of STOs include: 24/7 trading, fractional ownership, operation cost reduction, compliance automation, and mainly liquidity premium. STOs have been a crowdfunding activity of choice for an increasing amount of projects int he past three years. While just a handful of project conducted them in 2017, the amount rose ten fold in 2019. Yet, the total amount of companies doing STOs to date is much smaller, and counted in dozens, compared to thousands of ICOs. While STOs have been used predominantly for tokenizing equity, other alternatives include tokenization of physical assets or debt instruments too. In here, as in tokenization in general, Ethereum has been the leading platform of choice for the vast majority of projects.One of the earliest STOs in the history was an equity sale in Blockchain Capital in 2017 that raised $10 million. As expectations were accumulating on the market Overstock’s blockchain arm company tZero, that operates as a security token exchange, managed to raise $134 million in 2018 which has been the largest reported STO to date. Since 2017, multiple platforms emerged claiming their specialization in issuing security tokens. These include for instance Securitize, Swarm, Harbor, Polymath or Neufund.

Yet, the STO hype has not been matched with the bitter look of reality. In fact, they have far from becoming widely adopted vehicle for fundraising as many expected. While most of the ICOs could avoid being labeled as securities or financial instruments for that matter, securities are indeed a financial instrument that is regulated in every country. With many jurisdictions having their own specific set of rules for overseeing these vehicles, the world is not yet ready for tokenizing assets on a global permissionless system. To be more precise, especially the world of the fusty legal frameworks failing to accomodate novelties of the reality powered by technological advancements.Sluggish adoption of security offerings manifested itself in June 2020, when one of the security token issuance platforms, Germany-based company Neufund closed down their operations stating the failure to act from the regulators’ side, namely Germany’s Federal Financial Supervisory Authority (BaFin), as the main reason for doing so. Neufund’s CEO Zoe Adamovicz expressed her frustration for Coindesk:

The problem is that nobody wants to take the responsibility for neither letting innovation happen, nor for banning it. We were neither allowed, nor not allowed. BaFin’s default answer is to shy away from risk and responsibility.

Nevertheless, if there is one thing blockchain can do best, it is ownership tracking of goods. Especially the virtual or digital goods where blockchains may significantly reduce the trust assumptions placed on the whole system. While tracking ownership of physical goods is trickier as it requires a bridge between the blockchain and the physical world. This bridge may be indeed corruptible, and thus is a security hole. Yet, utilizing blockchain, whether permissionless or permissioned, for such a thing does make sense and often times represents a significant improvement over the current status quo. Like decentralization, trust assumptions exist on a scale, and are not binary. While using blockchain for tracking, say, golden bars or food supply chains is far from the Cypherpunk dream of trustless systems, it may significantly improve the legacy processes in place with minimizing the need to trust at least to some extent. At the same time, these applications are far more trust-based as advertised by the corporations selling them. Chances are quite high that we will see many different assets on blockchains in the future. In fact, quite an interesting selection of them is there already.

Non-fungible Tokens — NFTs

The vast majority of ICOs used, now already an iconic, ERC20 token standard that provided the most basic functionality needed for fungible tokens. The standard got introduced in 2015 and simplified the process of embedding a set of basic functions into tokens on Ethereum. This reduced complexity of issuing new tokens as well as integrating them on exchanges in a secure way. Over time, a few extensions were developed to improve ERC-20 tokens and provide additional functionality such as transferability pausing, time locking or restricted ownership. Later on, other different standards emerged addressing some of the security vulnerabilities — in the form of ERC223 — or limited transaction handling mechanisms — as in ERC777.

Another small revolution, however, came with the introduction of the ERC721 standard in 2017. This one aimed to do the same thing ERC20 did, but for non-fungible tokens. Non-fungible tokens differ in that they are unique. While tokens using ERC20 were all the same and indistinguishable — a trait we want from money — ERC721 was made to track assets that carry unique properties. As most of the stuff we know actually. Examples include digital game items, event tickets, or even ownership of physical assets, but most famously, given the space we are talking about — collectibles.

Non-fungible tokens, or NFTs, appeared to address quite a massive issue that many of us suffer from, but only a few are aware of. We do have, use, and often even pay for digital stuff that we never really own. This issue is most frequently present in the gaming world where players spend dozens of billions on various in-game items such as avatars, their skins, or weapons etc. Even though they pay for it, the items are controlled by the developing company that may decide upon the fate of these items.Having a trustless global underlying protocol — such as Ethereum — for storing ownership rights for digital items, not only in games, is something of a great value. The benefits it brings are vast and include interoperability, liquidity, programmability, and provable scarcity. Apart from spending loads of money, players also do spend an incredible amount of man-days in their favorite virtual worlds, and thus accumulate a tremendous value in them that is locked in proprietary systems. Emergence of a NFTs on top of a global massive database allows this value to flow freely amongst different systems, massively improving efficiency of allocation of resources.

Say, I have a virtual mansion, on a virtual land, in a virtual world. I do spend quite some resources to equip my mansion in a way I barely could in my real life — either because of the income or physics limitations. I can choose between creating the equipment and decorations myself, buying these goods available on the open market, or hiring someone to create custom ones for myself. All of these things — the land, mansion or equipment — are cryptographically tracked in the form of ERC721 tokens on Ethereum blockchain. I am the sole owner of them, not relying on a third party provider — such as a developer of the world I am in. Moreover, I can trade my virtual property on external marketplaces, and some of it may even be imported into other virtual worlds. Once I decide to leave that particular virtual world, for whatever reason, the value I have accumulated through time and resources spent will not go in vain as all of these assets are liquid.Now, this is not just a theoretical example, but a real story. The virtual world in question, that I have selected for my virtual home is called Somnium Space, and the parcel on which I have my modest condo has an unique identifier — #1014. Feel free to come and say hi anytime. And who knows, you may be able to acquire it in an auction on marketplaces such as OpenSea.io once I decide to dump it.

The paradigm described above is quite different compared to the one which hundreds of millions of gamers have been used to in the last decades. Now, substitute the virtual world from the example by a university you attended, and the virtual mansion by your degree certificate. Imagine the free flow of information allowed by permissionless infrastructure and standardized data formats. You can perform a similar mental exercise by drawing this analogy in the realm of digital documents, or other assets of all kinds flowing between currently walled gardens of institutions on a national, or even international level."The Internet of Value" has been often associated mainly with blockchain’s monetary value transfers, but I’d argue the term entails much more as it enables making proprietary systems of all institutions, whether in the public or private sphere, interoperable.As the NFT standards have been evolving, an increasing range of operations gets easier to perform. ERC1155, pioneered by the team behind Enjin project, allows to track a whole asset class, instead of single item. ERC998 allows to create “composables” that enable merging non-fungible tokens together with fungible ones. At the same time, this blockchain-powered provenance mechanisms can be complemented by various metadata information that may or may not be baked into the smart contracts themselves. As the on-chain storage is very scarce, most of the teams opt in for off-chain option using centralized servers or tools like IPFS.

The history of non-fungible tokens dates back to emergence of “colored coins” built on Bitcoin. The first paper — authored by Meni Rosenfeld — appeared in late 2012. The author elaborated on the whole concept in another paper the next year in which he teamed up with Vitalik Buterin and others. The concept had its weaknesses which eventually led to creation of the Counterparty protocol in 2014. Counterparty reduced complexity of creating unique assets on the Bitcoin’s blockchain and some of the projects took advantage of it.

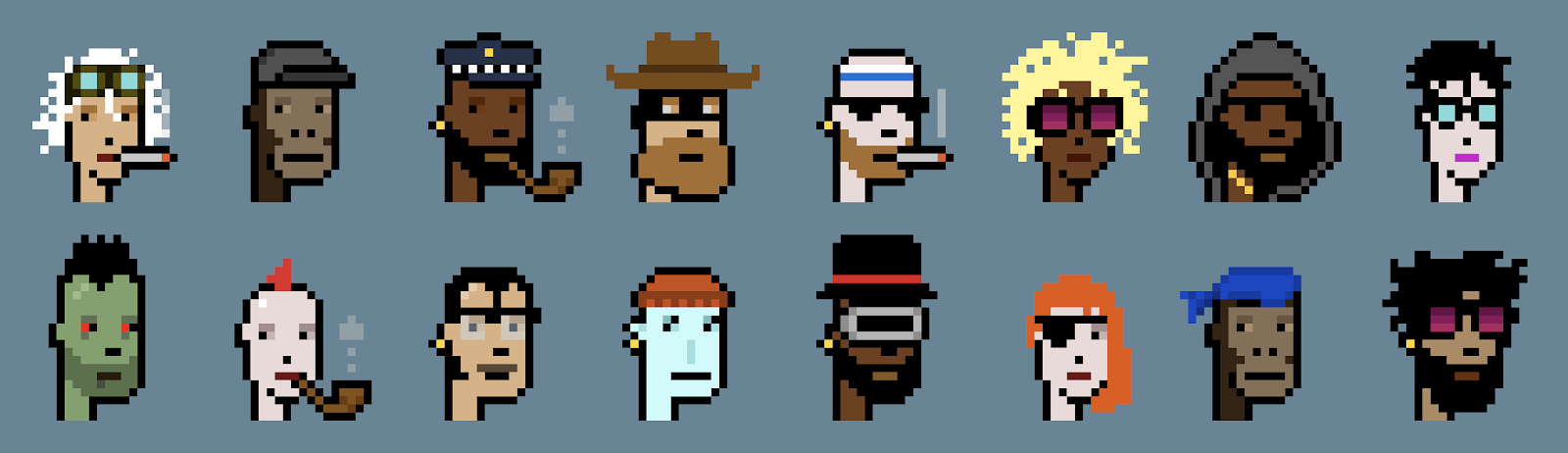

In 2015, the game creators of Spells of Genesis conducted one of the early ICOs and in addition to that issued their in-game assets using the Counterparty protocol. In 2016, a popular trading card game Force of Will launched their cards on the platform too which brought the notion of blockchain-issued assets closer to the mainstream. None of these project, however, managed to gain such a fanbase as an iconic meme collection of Pepe the Frog, known as Rare Pepes, that launched the same year. Some pieces of this early crypto art project sold even in a live auction in New York.As Ethereum had been gaining prominence, most of the NFT projects switched to its chain. Including the memes. A decentralized meme marketplace and trading card game called Peperium was reportedly the first of such projects to launch on Ethereum in early 2017. Soon after, another iconic project appeared — Cryptopunks. This collection of 10 000 unique characters has become inspiration not only for many crypto art projects to come afterward, but also to the ERC721 standard as such. These 24x24 pixel images were initially allowed to be claimed for free by anyone with an Ethereum wallet, but the secondary market started to thrive very soon as they all got claimed quickly and since then thousands of trades have happened. The average sale price of a single punk is at 0.86 ETH which is at the time of writing equivalent of roughly $400. But many of the punks with rare attributes trade for thousands of dollars. The collection has been part of multiple art exhibitions as well. The largest milestone in the history of NFTs was yet to come, though.

Source: Larvalabs.com

Launched in late 2017, CryptoKitties was the first NFT project that went mainstream, and also the first one to utilize what we now call ERC721. A rather simple on-chain hybrid of game and collectibles based on breeding of digital cats that produced new cats of different rarity. The original “Generation 0” cats were sold in a descending-price Dutch auction, and traded on a secondary market afterward. This later became one of the primary price discovery mechanisms for NFTs.

Shortly after launch, the community of breeders got so big that CryptoKitties almost single handedly caused congestion of the whole Ethereum network. People started to trade kitties in unbelievable volumes of thousands of ethers, and insane prices of hundreds of ethers. The most valuable digital cat was sold for an equivalent of $110 000, at the time of sale. The hype peaked in December 2017 and gradually slowed down in the following weeks. Nonetheless, the company behind the popular kitties — Axiom Zen — spun out Dapper Labs which raised millions of dollars from some of the top investors like A16Z or Google Ventures.

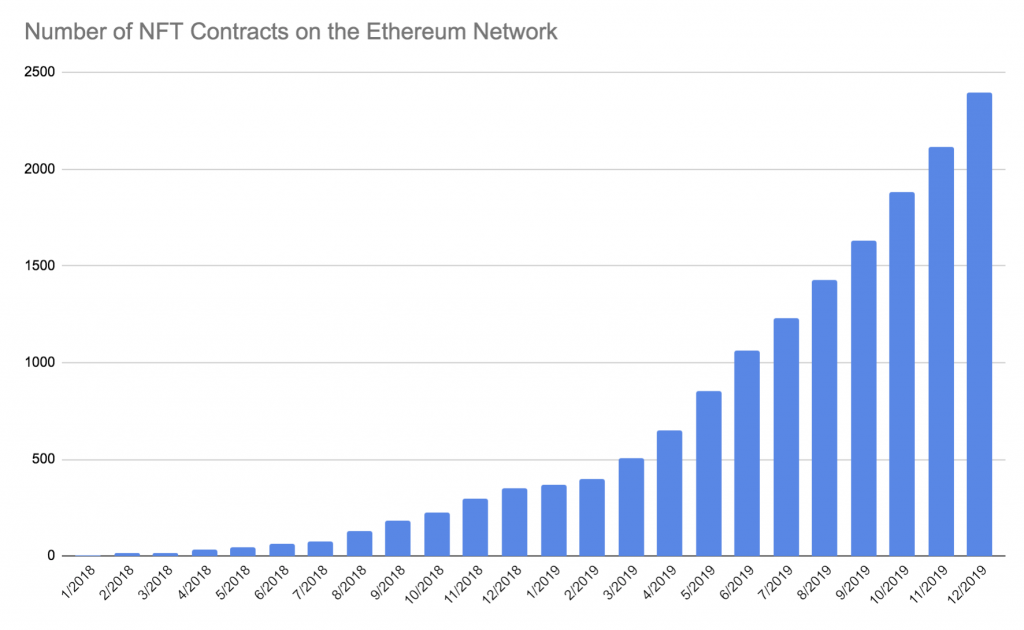

CryptoKitties triggered the Cambrian explosion within the NFT space with hundreds of projects entering the arena. A number of projects — such as CryptoDoggies, CryptoBots, CryptoFighters, or CryptoTittiez — tried to capitalize, more or less successfully, on mimicking or mocking the the kittens, while some other — like CryptoCelebrity, Gods Unchained, MyCryptoHeroes etc. — came with their own innovative game mechanisms. NFT marketplaces such as OpenSea, KnownOrigin and SuperRare have been gaining prominence and accommodated hundreds of projects. These started emerge also on other blockchain such as EOS or Tron. The NFT market capitalization reportedly reached over $200 000 000 with over 110 000 users in 2019. Digital collectibles — or crypto collectibles — continue to be one of the major categories on the market.This is likely continue to be the case as digital art blockchain are a good fit. Recently, the team behind Cryptopunks pioneered in introducing the first “on-chain” generative art on Ethereum in the form of Autoglyphs. It wil be interesting to see where this self-contained mechanism for the creation and ownership of artwork will lead. Other categories such as games, art, utilities, or metaverses are gaining more traction. This has been augmented by the evolution of the NFT infrastructure in general. NFTs are getting into Layer 2 as well, tools like Mintbase and Mintable make it easier to create new NFTs, servers like NonFungible.com provide useful market metrics, and venture capitalist too are entering the space.

Source: Opensea.io

The NFT market is still at very nascent phase, with daily active users counted only in thousands, but all these developments gradually increase its level of maturity which opens up new horizons — in both technological and economical sense. In 2020 we could see the dawn of these horizons. New platforms such as Yiedl or Rocket will allow people to get NFT-collateralized mortgages and loans. The virtual economy is becoming “real” more than ever. Covid-19 just accelerated this trend as most of the meetings, meetups and conferences shifted to the virtual realm. This was reflected also in the Virtual Reality market as consumer-grade VR headsets that have become widely accessible are peaking in demand. The average prices for a parcel of virtual land in blockchain-friendly metaverses such as Decentraland, Cryptovoxels, The Sandbox, or already mentioned Somnium Space have been rising by hundreds of percent in the first half of 2020. Based on what we see happening people will soon be able to take mortgages to buy these parcels, or use them as a collateral to get loans. All this in a peer-to-peer, non-custodial and trustless fashion. In fact, the first loan collateralized by an ENS domain has been already issued early this year. Moreover, ENS domains are getting integrated with DNS through projects like Kred. Blockchain-based NFTs have recently arrived to Minecraft. We can only guess when other incumbent of the industry will follow.With an increasing number of both tokenized assets and investors on the NFT market, liquidity issues will be addressed, and the aftermath of having such an incredibly diverse spectrum of assets on one globally distributed database is beyond our comprehension. The convergence of new forms of media, esports, virtual reality, gaming, and finance will propel the NFT space into a multi-billion industry. The Internet of Value on steroids.

Decentralized Autonomous Organizations

Decentralized Autonomous Organizations, or DAOs, have been the flagship concept of the Web3 era. These organizations live as autonomous entities on the Internet, and are governed by the rules encoded in their smart contracts. By removing the hierarchical management structure they represent a significant paradigm shift in respect to the way communities are run and operated. The governance mechanism based on smart contracts on top of a globally available and transparent database brings notable enhancements in transparency, automation and efficiency in general when it comes to running organizations.

In the context of the current work and collaboration trends on the labor market, it is not hard to imagine that relevance of DAOs will only grow in the future. According to Nasdaq, the freelance workforce is predicted to rise to 43% by in 2020. Merging this trend with proliferation of the concept of Teal organizations, introduced by Frederic Laloux in 2014, it may not be too much of a stretch to claim decentralization will penetrate our society in multiple levels. Teal organizations are characterized by accent on self-organization, self-management, flexibility, and employee autonomy. The concept draws an analogy between the inner workings of an organization and the myriad of autonomous operations performed in an organism. Similar patterns have been known in the concept of Holacracy that preceded Teal organizations. Leaving aside details of implementing such organizations, the main goal here is to create more resilient social structures that are more adaptive. The same applies in DAOs. Their ultimate promise is to eventually reinvent governance of corporations and the society in general.

Due to their distributed nature, the term DAOs often get interchangeably used with Dapps. In general, all DAOs can be considered to be Dapps, but not all Dapps are actually DAOs. Similarly as with blockchain, no strict definition of DAOs has been codified yet. Some argue that we could consider cryptocurrency networks such as Dash or Decred the first instances of DAOs. This is mainly because they introduced sort of on-chain decision-making, especially when it comes to the treasury governance. Both of the networks have a mechanism in place where 10% of their block rewards are set aside for the treasury fund. Anyone is free to submit proposals and ask for funding. The network stakeholders then may vote directly through the blockchain, and decide upon distribution of these resources. Tezos took this idea even further with its self-amendable blockchain where token holders can vote on protocol upgrades in a similar manner. The first such amendment in Tezos, codenamed Athens, occurred in May 2019.Conceptually, assessment of the aforementioned cryptocurrencies themselves as DAOs is right, and therefore we can call them Layer 1 DAOs. The way the term is typically used, however, refers to a set of smart contracts that result in business logic governing the capital flows and parameters of a DAO. Apart from the pooled funds, and contractual logic that governs them, DAOs usually have an explicit purpose, and incentives in place to ensure long term sustainability.

The DAO

The concept of decentralized autonomous organizations got popular with the (infamous) DAO. The DAO was created in May 2016 by a few members of the Ethereum community. It was designed to operate as a Venture Capital fund focused on the crypto space. During the creation period, or sort of an ICO, anyone could send ethers to a unique address and receive DAO tokens in return. Over 11 000 investors did so, including myself, and contributed almost 12 million ethers which was at the time nearly 14% of all ethers in circulation. By the end of May, this was equivalent to $150 million. The DAO happened to be the largest crowdfunding project in the human history at the time.The governance mechanism of the DAO allowed the majority of the token holders to suppress the minority. Similarly, as in publicly-traded join stock companies. Therefore, the creators implemented the so-called “split” function that allowed the minority to retrieve their funds in case they disagree with the proposal approved by the DAO, and refuse to take part in it. Calling the split function would then create a “child” DAO where the funds of all those who want to fork off would be spilled over to. Moreover, some additional measures were implemented into the code that prevented the funds in the new child DAO to be moved for four weeks. Probably nobody assumed that they will be so helpful in no time.

Merely a few days after the crowd sale, on June 16th, unknown attackers found a loophole in this procedure, and exploited a combination of vulnerabilities which allowed them to drain a third of the funds to an account under their control. They did so by recursively calling the split function, and thus withdraw their funds multiple times. The account was, however, subjected to the holding period of 28 days. Interestingly enough, the security vulnerabilities had been identified a few weeks before the attack in a paper by Emin Gün Sirer, Vlad Zamfir and Dino Mark. The events that followed after the attack offered a vivid and fascinating discussion that would shape the future of Ethereum, and its forks. In an open courtesy letter, the attacker justified his action claiming that anything he did was in accordance with the code — and as it went in the Ethereum community — the code is the law.

To the DAO and the Ethereum community,I have carefully examined the code of The DAO and decided to participate after finding the feature where splitting is rewarded with additional ether. I have made use of this feature and have rightfully claimed 3,641,694 ether, and would like to thank the DAO for this reward. It is my understanding that the DAO code contains this feature to promote decentralization and encourage the creation of "child DAOs".I am disappointed by those who are characterizing the use of this intentional feature as "theft". I am making use of this explicitly coded feature as per the smart contract terms and my law firm has advised me that my action is fully compliant with United States criminal and tort law. For reference please review the terms of the DAO:"The terms of The DAO Creation are set forth in the smart contract code existing on the Ethereum blockchain at 0xbb9bc244d798123fde783fcc1c72d3bb8c189413. Nothing in this explanation of terms or in any other document or communication may modify or add any additional obligations or guarantees beyond those set forth in The DAO’s code. Any and all explanatory terms or descriptions are merely offered for educational purposes and do not supercede or modify the express terms of The DAO’s code set forth on the blockchain; to the extent you believe there to be any conflict or discrepancy between the descriptions offered here and the functionality of The DAO’s code at 0xbb9bc244d798123fde783fcc1c72d3bb8c189413, The DAO’s code controls and sets forth all terms of The DAO Creation."A soft or hard fork would amount to seizure of my legitimate and rightful ether, claimed legally through the terms of a smart contract. Such fork would permanently and irrevocably ruin all confidence in not only Ethereum but also the in the field of smart contracts and blockchain technology. Many large Ethereum holders will dump their ether, and developers, researchers, and companies will leave Ethereum. Make no mistake: any fork, soft or hard, will further damage Ethereum and destroy its reputation and appeal.I reserve all rights to take any and all legal action against any accomplices of illegitimate theft, freezing, or seizure of my legitimate ether, and am actively working with my law firm. Those accomplices will be receiving Cease and Desist notices in the mail shortly.I hope this event becomes an valuable learning experience for the Ethereum community and wish you all the best of luck.Yours truly,"The Attacker"

The philosophical foundations of Ethereum suggested to do nothing and leave the state as it was. Another option, sort of “semi-compliant” with the founding principles, was to exercise a soft fork that would declare all transactions making calls to reduce the fund in the child DAOs invalid. The third option involved a hard fork and rewriting the transactional history. Many argued this would defeat the purpose of blockchain as such — the immutability of data. Moreover, such an action would create a dangerous precedent for the future. If the community allows to undermine its foundational principles in such a radical manner, especially so early at the nascent stage with “only” millions of dollars in the game, will it be able to resist the same pressure once the stakes are in billions? It was a hard decision to make, and the one to be made collectively.Of course, in reality there were more options available with different twists, and all of them had their proponents. Initially, the soft-fork seemed to be gaining the majority of the support but was discarded due to additional security flaws it would pose. With this option being off the table, the hardfork gained momentum. Eventually, the social consensus dominated over the technological one. The Ethereum community decided that the hack was too big to let go, and the hardfork was voted, and accepted by the major part of the community. It was executed on 20 July 2016, with the block 1 920 000, and the victims of the hack got their funds back. Gavin Wood, the co-founder of Ethereum, called this moment "the single most important moment in cryptocurrency history since the birth of Bitcoin."

Not everyone agreed with the actions taken, though. A minor part of the community, approximately 10%, remained loyal to the concept of the immutable ledger, and decided to keep following the chain on which the hard fork did not happen, and dedicated computing resources — the hash power — to sustain it. This blockchain was named Ethereum Classic (ETC), and it has been living its own life on its own terms ever since.The hack, and subsequent hardfork meant the fall of the DAO, and its tokens were delisted from major exchanges such as Poloniex and Kraken. Moreover, a year after the DAO crowd sale, SEC stated in their report the DAO tokens were securities, and their sale violated federal securities laws. Nevertheless, the whole situation has been a great learning experience not only for the crypto community. We are likely to see further conflicts between the code and the law in the future. As for the sibling network, four years after the contentious fork, Ethereum is the second most valuable cryptocurrency network with the market capitalization of $50 billion — with $450 per ether, while Ethereum Classic occupies the 33rd place with overall value of $7000 million, and $6 per coin. Similar ratio is present when comparing their hashrates, too.

The Dawn of DAOs

Even though the DAO ended disastrously, nowadays DAOs are playing a vital role in the cryptocurrency system. The two most popular frameworks that are being used by many projects are Aragon and DaoStack. Aragon started off with one of the largest and fastest crowdfunding events not only in the Blockchain space but also in the world’s history at the time — raising $25 million in under 30 minutes in May 2017. The project’s vision to become a digital jurisdiction for decentralized organizations has been appealing to many, and fuelled the demand for the ANT governance token. Aragon let the aspiring decentralized movements to manage their voting, fundraising, or accounting practices using the platform. Three years since the token sale, the platfom has been used by hundreds of DAOs, and introduced a fundraising app with architecture modelled after Vitalik Buterin’s description of a Decentralized Autonomous Initial Coin Offering (DAICO) where accountability of project developers is enforced by smart contracts as token holders allocate funds from discretionary vault. Moreover, the system uses a bonding curve smart contract that plays the role of an automated market maker facilitating the exchange of user’s deposits for organization-specific tokens. Perhaps one fo the most recognized projects using the Aragon framework are the KyberDAO, PieDAO or a virtual reality world Decentraland. It’s founder Luis Cuende has been vocal about fixing the current issues we are experiencing in democratic systems:

Democracy has been fundamentally broken for a while. At least as a way to govern large groups. We don't have a clear successor to it, but we need to stop being nostalgic about the past and experiment with new models.

DAOstack has become the second most popular infrastructure for building DAOs and the platform of choice for projects such as PolkaDAO or DutchX. It deploys a novel holographic consensus which blends prediction markets with policymaking, and implements reputation-weighting. Furthermore, this reputation can be assigned or stripped off by a DAO. Both of the platfors make certain design tradeoffs, and it remains to be seen how these play out in the wild jungle of the Internet.Other alternative frameworks that got popular include Colony and MolochDao. Despite of some design differences, both frameworks aims to achieve the similar goal — to ease creation of DAOs, and thus unleash their potential to transform our society with new governance models such as futarchy, liquid democracy, or holacracy.

Source: Delphi Digital

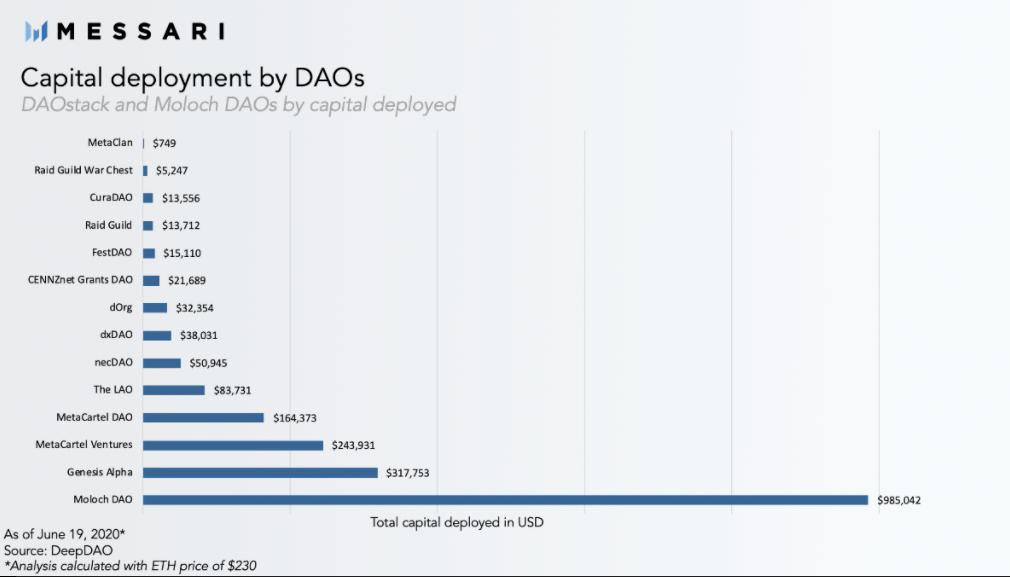

During their short history, DAOs have found their place mainly in the area of Decentralized Finance (DeFi) that we will talk about more in depth in the next chapter. There are major functions that DAOs typically perform. The first one is akin to a fund that allocates resources according to the will of the stakeholders. These resources are not necessarily investments as in the case of The DAO, but often grants supporting a given ecosystem as in the case of the MolochDAO or DigixDAO.The other predominant use case of DAOs relates to governance of a particular dapp where token holders vote and decide upon various issues and parameters within the dapp. This is the case with the MakerDAO where MKR token holders decide on e.g. stability fees that determine costliness of loans on the Maker platform, or dxDAO where the community can update smart contracts, or change the fees within the DutchX trading protocol. There are some other minor, yet important usecases such as generation of random numbers in a somewhat tamper-proof and trustless way as seen in RanDAO. The DAO ecosystem is still at a very early stage but nonetheless exhibits signs of a vivid activity. The amount of capital hold by these organizations has been steadily increasing even though it counts “only” in millions.

Source: Messari

In the grand scheme of things and the direction the web and our society are going towards, DAOs will play an important role. New governance models they enable promise fixing administration inefficiencies present in governments, corporations as well as non-profit organizations, even though they are yet to be battle-tested. Above all, DAOs bring radical and tamper-proof transparency into many processes that have not been tapped by this virtue yet. Furthermore, their distributed nature provides a far better match to the global communities appearing all over the world than the legacy frameworks fenced by national rules. DAOs truly create digital jurisdictions within cyberspace, and the (Ethereum) blockchain has become the backbone on which they all reside.