Chapter 04

The Evolution of the Crypto- currency Ecosystem

I’ve been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party.The paper is available at:http://www.bitcoin.org/bitcoin.pdf

This is what Satoshi Nakamoto wrote to the members of the Cryptography Mailing List on October 31, 2008. According to his words, he began coding Bitcoin around May 2007. The first reaction to his post came two days later, with an objection to the system’s limited potential in terms of scalability. Over the course of the next few days the discussion went back and forth between technical and political aspects of Bitcoin. And some members pointed out that cryptography will not provide answers to problems of the political nature. Satoshi agreed:

Yes, but we can win a major battle in the arms race and gain a new territory of freedom for several years. Governments are good at cutting off the heads of a centrally controlled networks like Napster, but pure P2P networks like Gnutella and Tor seem to be holding their own.

The most enthusiastic replies came from Hal Finney, who threw out many questions at Satoshi and became very interested in helping him out with his project. Satoshi released the code in November 2008, and launched the software on his computer on January 3, 2009. For the first few days, he was the only miner on the network. Then, he would execute the first transaction in the network, which ended up in Finney’s wallet.Naturally, one of the subjects that was repeatedly invoked in discussions related to Bitcoin was the origin of its value. To some, it was not clear how bitcoins could accrue any monetary value. Skepticism was not rare. But Satoshi foresaw that Bitcoin might have to start small and work its way up gradually.

It could get started in a narrow niche like reward points, donation tokens, currency for a game or micropayments for adult sites. Initially it can be used in proof-of-work applications for services that could almost be free but not quite.

Satoshi’s paper might not have explained all the systemic mechanics in detail, and as pointed out by academics, did not cite and refer to previous academic work on some of the Bitcoin components, but in his own words, he was not so eloquent with words and he preferred to craft code instead. He even created the software itself first, and just wrote the paper afterwards.

The project was initially discussed on the SourceForge website and by November 2009, when Satoshi launched Bitcoin forum, hosted at bitcointalk.org, the nascent project already had a handful of people vividly supporting it. The bitcoin.org domain was registered by Satoshi and another early developer, Martti Malmi, in August 2008. Its ownership has been passed among multiple people from the community, which often caused controversies and disputes. The topic of domain ownership resurfaced also in 2020 when one of its co-owners, Cobra-Bitcoin, announced he wanted to cut ties with the site. Part of the community had accused him of fancying Bitcoin Cash, whose supporters have been in control of the bitcoin.com domain. As Cobra's allegiance had been questioned, he defended his stance in a long Github discussion thread:

I’m sorry if I don’t call Bitcoin Cash “Bcash”, or hate it with a fiery passion (I used too), or I don’t have exactly the same set of opinions as you. But that doesn’t mean you can attempt to pressure me into handing over the domain to some random group (of strangers no less!). This type of witch-hunting is so crazy. Since when did we turn so easily against each other over our opinions? When did everyone get so batshit tribalistic and insane?

Nonetheless, bitcoin.org has been a primary source of information about Bitcoin Core since its beginning, and its regular activities have been organized through the public pull requests process. Co-maintainers of the site have served only as an extended hand of the ever-increasing community. The timing of Bitcoin’s emergence was impeccable. In the light of the financial crisis, the geopolitical events of the time favored Bitcoin, and fostered enthusiasm and drive of the community to polish the code that could deliver the substance needed for the financial and technological revolution.

Around the same time, the first exchange rate was established in October 2009. It was derived by calculating the cost of electricity needed for a computer to generate a bitcoin. At that time, $1 USD was calculated to equal 1309 bitcoins. The price would soon march on in small upward movements. Price-related skepticism, along with enthusiasm, has been present in the Bitcoin community from fairly early on. When the price moved from 1 cent to 25 cents, many were vocal about Bitcoin being a speculative bubble. A twenty-five fold price increase undoubtedly did seem like a bubble and no wonder that some were worried about the (un)sustainability of such a trend. It would take almost eight years for this exchange rate to be inverted. It happened in April 2017 when a single bitcoin cost $1309.

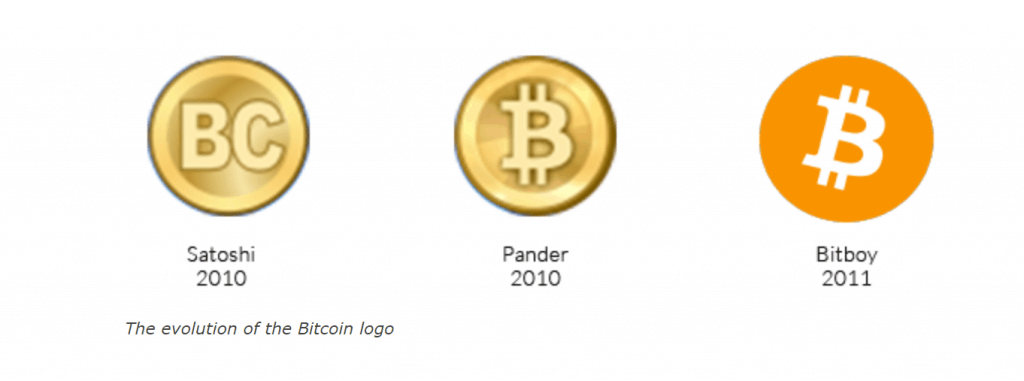

Source: Bitcoin History Part 2: The Bitcoin Symbol

The Thai baht currency symbol — ฿ — was proposed for Bitcoin but some members were worried that it may cause confusion. In November 2010, a user nicknamed “bitboy” proposed new symbol — ₿ — as well as a newly designed Bitcoin logo. The logo discussion had been a controversial one. Internal polls initially favored the Thai baht symbol, until 2017 when Bitcoin finally gained its unicode symbol with Bitboy’s proposal.

For my first Bitcoin coding project, I decided to do something that sounds really dumb: I created a website that gives away Bitcoins. It is at: https://freebitcoins.appspot.com/Five ฿ per customer, first come first served, I've stocked it with ฿ 1,100 to start. I'll add more once I'm sure it is working properly.Why? Because I want the Bitcoin project to succeed, and I think it is more likely to be a success if people can get a handful of coins to try it out. It can be frustrating to wait until your node generates some coins (and that will get more frustrating in the future), and buying Bitcoins is still a little bit clunky.

This is what Gavin Andresen announced on the Bitcoin Forum in June 2010. Anticipating that once people would play around with the wallet and coins they would be incentivized to understand Bitcoin deeper, he banked on giving out as many as he could. And he was right. The community’s response was more than welcoming. All that was needed was signing up on a website, completing a captcha, and then one had the ability to claim 5 bitcoins. It was a good deal even though it amounted to barely a few cents. When Andresen’s faucet dried up after the first 1100 coins, the community chipped in, and in the following months, almost 20,000 bitcoins were dispensed to random people on the website. These altruistic deeds helped to spread the word and coins and to bootstrap the community before the first upcoming parabolic price spike. Andresen later took over the control of the source code repository from Satoshi who entrusted him to lead the project. Andresen extended the team in the following years and eventually stepped down in the summer of 2014.

Satoshi was last active on the Bitcointalk forum on December 13, 2010, when control of the code repository was handed to Gavin Andresen who was by then a well-recognized developer and advocate of decentralization. In just over a year, his activity on the forum numbered 575 posts.

2010: Bootstrapping the New Monetary System

I’ll pay 10,000 bitcoins for a couple of pizzas.. like maybe 2 large ones so I have some left over for the next day. I like having left over pizza to nibble on later. You can make the pizza yourself and bring it to my house or order it for me from a delivery place, but what I'm aiming for is getting food delivered in exchange for bitcoins where I don't have to order or prepare it myself, kind of like ordering a 'breakfast platter' at a hotel or something, they just bring you something to eat and you're happy!

This was posted by Laszlo Hanyecz on Bitcointalk on May 18, 2010. The amount of bitcoins he offered was equivalent to something over $41 at the time. Even though his posts caught the attention of many, the people interested were often outside of the US and 10,000 bitcoins were not worth the hassle for them. He had to prepare the food for himself that day, as well as for the next few days, but eventually he achieved his goal and received a pizza on May 22. His purchase achieved fame as the first commercial transaction involving bitcoins. This deed sparked a new tradition of calculating how much pizza would be valued at the current price.

While the most famous cryptocurrency exchange — Mt. Gox — launched very early, it was not the first. That honor went to the Bitcoin Market that kicked off in March 2010. Shortly after, Mt. Gox was launched in Japan in July 2010 by Jed McCaleb. It was named in honor of the game Magic the Gathering. It was for a long time the largest Bitcoin exchange. Eventually, it became known as the largest hack ever in Bitcoin history.Multiple sources, including former employees of the company, depicted its operational and security processes as very poor. This only worsened as Bitcoin’s early infrastructure lacked many features it has today. For instance, most wallets today encrypt the private keys they generate with a password. This feature came only with the release of Bitcoin 0.4.0 in September 2011, and thus was not present on Mt. Gox.Therefore, before this, an attacker did not need any special password to access stolen private keys. Regardless of that, Mt. Gox is to be blamed for the many mistakes related to their operational security, and thus the hack itself. Some of these mistakes are hard to believe given the amount of money that flowed through the company’s accounts. Not only were the private keys holding thousands of bitcoins of their customers compromised, but oftentimes their internal systems would misclassify the funds being transferred by the thief. There were instances when the funds being stolen were interpreted as deposits to various customers. This led to the illusionary creation of tens of thousands of bitcoins in their internal databases. The customers, naturally, preferred to withdraw their newly acquired bitcoins rather than report it. Moreover, bitcoin deposits kept coming in from customers to addresses that had compromised private keys. As absurd as it sounds, that had been happening for almost two years. Over time, the hacker regularly emptied the wallets. This preposterous situation led the company to file for bankruptcy in early 2014, claiming that more than 750,000 bitcoins were missing.

In 2017, the hacker was identified as Alexander Vinnik. In the end, he was investigated for having laundered over $4 billion. Vinnik had reportedly sent a large portion of the stolen bitcoins to another exchange called BTC-e. The forensic analysis suggested that some of the 300,000 bitcoins he deposited to the exchange moved straight to internal storage rather than to customer deposit addresses. That, indeed, hints at a relationship between Vinnik and the exchange. Some of the stolen coins were laundered through other exchanges, and a portion even through Mt.Gox itself. At the same time, Vinnik handled coins from 2011 and 2012 hacks of other exchanges such as Bitcoinica and Bitfloor, too. As of 2021, it still has not been confirmed whether Vinnik was the hacker himself or he just offered the laundering of them for clients. Either way, it seems that he is the crucial piece in the puzzle. It is unclear when the Mt.Gox case closed and its creditors remediated.

Over time, the case has transformed from bankruptcy proceedings into a civil rehabilitation process. In early 2019, Mt.Gox civil rehabilitation trustee, Nobuaki Kobayashi, announced a six month delay in proceedings due to disputes on disapproved claims made by CoinLab, the company founded by Peter Vessenes that formed a partnership with Mt.Gox to process money transfers from its customers in North America. The company claimed almost US $16 billion, two and half times as large as the sum of total of all approved claims combined. This caused significant delays in the process, much to the dismay of other creditors. CoinLab initially sued Mt.Gox in 2013 for breach of contract for the sum of $75 million. Some media reported that CoinLab intends to bring the case to the United States from Japan, which could drag the claim process for another few years. Nonetheless, the story of Mt. Gox has been tied with the Bitcoin world almost throughout its entire history and this is unlikely to change in the near future.

2011: Evolution the Bitcoin ecosystem

2011 was the year when Bitcoin’s reputation took off, reflected most assuredly by its price. Bitcoin started the year at just $0.30, and hit parity with USD on February 11. Likely the first major push of credibility came in January when the Electronic Frontier Foundation announced they would accept bitcoins for donations. Soon after, the infamous marketplace named “Silk Road” launched in February of the same year and used bitcoins exclusively as the currency of choice. It would remain in operation for two and a half years until the autumn of 2013. By June 2011, WikiLeaks announced they would accept bitcoins for donations as well. By then, a single Bitcoin was priced at $31. The price dropped dramatically to just a few cents per Bitcoin the very same month after a security breach at Mt. Gox. Meanwhile, its founder, McCaleb, began work on his next project — OpenCoin — which would be later transformed into the Ripple protocol. Litecoin and a few other first “altcoins” also popped up in late 2011. By then, the Bitcoin price consolidated to around $5 by the end of the year.

Bitcoin had also begun growing and getting increasingly more traction in the media, along with its user base. Bitpay, a payment processing service, reported in October 2012 that it had registered over 1,000 merchants accepting bitcoins. Back then, much like today, there were plenty of arguments and disagreements within the community. But still quite early with no land to fight over, the focus was on making Satoshi’s vision a reality. Over time, though, interpretations of Satoshi’s vision started to diverge, which led to division and tribalism, and eventually multiple forks of the Bitcoin source code.A part of the community felt there was a need to create an umbrella organization that would support promotion, development, and growth of the Bitcoin ecosystem. Therefore, the Bitcoin Foundation was founded in September 2012. It was modeled after the Linux Foundation, and Peter Vessenes became the chairman of the board.. Other founders included Charlie Shrem, Jon Matonis, Patrick Murck, and Gavin Andresen, who was hired as “chief scientist”. One of the organization’s goals was to restore Bitcoin’s reputation, which at that point had soured, as it was often associated with trade of illicit goods.There is general disagreement on how successful the organization was in fulfilling this goal. Having some of the board members connected to various scandals did not help to boost the reputation of Bitcoin nor the foundation itself. Charlie Shrem, the foundation’ s vice-chairman, resigned and was arrested in early 2014 for aiding the operation of an unlicensed money-transmitting business, and pleaded guilty in September of that year. Mark Karpeles, then-CEO of Mt. Gox, resigned from the board around the same time after his exchange lost 750,000 bitcoins in one of the greatest hacks in history.The Bitcoin Foundation has been subject to criticism from both insiders and outsiders of the community. That accelerated when it focused more on lobbying and advocacy to work towards a favorable regulatory environment in the U.S. Some libertarians and Bitcoin advocates, at the time, disagreed with the organization’s strategy. The foundation had been historically associated with rather controversial people, which caused many within the Bitcoin community to disengage from it totally. The empty board seats left by Schrem and Karpeles were then filled by Bobby Lee and Brock Pierce. Pierce was elected as a new director, which resulted in an immediate resignation of at least 10 members of the foundation. Pierce’s past included allegations in lawsuits from three of his former employeesm claiming he had provided them drugs and pressured them into sex when they were minors. One of the resigning members explained his decision to decamp on the discussion page of the foundation with following comment:

The track record of prominent Bitcoin Foundation members has been abysmal. I no longer want to be associated with these people.

After these events, another rather controversial persona, Cody Wilson, a gun-rights activist who had become known for developing and distributing open source gun designs for 3D printing, announced his intention to run for a board seat in an effort to dissolve the organization from within. He was not successful. But further such attempts were made by other board members in the following months, efforts quickly halted by the remaining board members.By early 2021, the Bitcoin Foundation still operated with six board members listed on its website. Paradoxically, some of them have been known in the recent years more for their association with other cryptocurrency projects rather than Bitcoin itself. Pierce was involved as co-founder with EOS and their giant multi-billion dollar ICO, and according to his LinkedIn page he advised Bancor, Metronome, AirSwap, tZero and many cryptocurrency projects. Bruce Fenton was recently associated with Ravencoin, and Vinny Lingham is best known as co-founder and CEO of Civic, a digital identity startup.

An attempt at resurrection of what many wanted the Bitcoin Foundation to be was made in earnest in 2018 by some high-profile personas from the Bitcoin space. The “B Foundation” was then launched and promised to engage in research and development as well as providing grants to Bitcoin developers. The announcement came from Alena Vranová, former CEO of Satoshi Labs, and Giacomo Zucco from BHB Network.They received initial backing from people like Adam Back of Blockstream, Elizabeth Stark of Lightning Labs, Jameson Lopp of Casa, Bryan Bishop from Bitcoin Core and many others. Despite the support of many influential Bitcoiners, the organization came under heavy scrutiny by the community shortly after the announcement. Since the announcement, until the time of writing this chapter (almost three years later), the organization has not followed up with any announcements or activity.

In the spring of 2012, two important events occurred. The first was the hack of the trading platform Bitcoinica, one of the most infamous hacks of all-time, and the second was the announcement of perhaps the most iconic bitcoin application, a betting game called Satoshi Dice. While Bitcoinica’s ashes gave birth to Bitfinex, another prominent exchange, the game’s kick-off would be considered the launch of blockchain-based games. That said, part of the community perceived it more as a DDOS attack against Bitcoin, as it flooded the network with large amounts of transactions without fees. It became quite popular at the time, responsible for over half of all bitcoin transactions.

One of the inevitable side effects of digital money providing a certain level of anonymity was the emergence of Darknet marketplaces such as Silk Road. Enabled by a set of anonymizing technologies such as Tor, I2P, Whonix, Tails, and VPNs, as well as sophisticated reputation systems, they created an unprecedentedly seamless pathway for access to virtually anything. It was a true e-commerce revolution.Drugs, guns, various kinds of sensitive information, illegal pornography or even assassination services were listed for sale, akin to an Amazon-like user experience. Tor and its Onion routing protocol allowed anyone to hide their IP address, and thus mask their location. While it still takes some skill and experience to be able to cope with all the configuration necessary to protect one’s privacy completely, it is possible, and the Darknet markets were the practice ground of first resort. Vendors' identities and locations could be obfuscated to a degree unmatched by anything else on the Web. To this effect, Cypherpunk dreams were coming true. Because of this, Tor hidden services were difficult for law enforcement to target. Difficult, however, does not mean impossible. Darknet marketplaces come and go and their “liveness” is quite difficult to follow even for regular Darknet users. Silk Road managed to be operational for more than two and half years, and thus grew to unparalleled popularity. Its administrator, Ross Ulbricht, was arrested in October 2013 after long and arduous investigations by intelligence services and law enforcement agencies. On the Darknet, he went under the handle Dread Pirate Roberts (DPR). For some, he was a young visionary who committed no crime. For others, he was just another high-profile criminal.

The path to his creation was largely influenced by the famous economist Ludwig von Mises and the teachings of Austrian School of Economics, as well as his interest in psychedelics and Eastern philosophy. Eventually, he became a victim of his own success and ignorance, leaving several holes in his Tor invisibility cloak. Wired Magazine presented the rise and fall of Silk Road in an eye-opening report. Ulbricht ignored the warning signs around him. Many users alerted him of his IP address having been leaked. He would later make naive mistakes that led to revelation of his identity, including the posting of a question about database programming on Stack Overflow asking about "connecting to Tor hidden services using curl in php".

The email listed was his personal gmail account — rossulbricht@gmail.com. In 2015, he was sentenced to double life imprisonment plus forty years, convicted of money laundering, computer hacking, conspiracy to traffic fraudulent identity documents, and narcotics. After his arrest, allegations surfaced that he had hired assassins to “remove” some of his employees. In the end, he was not convicted on these charges. After his conviction, however, two federal agents involved in his case were put under investigation and eventually indicted for corruption. One of them, the lead undercover in the case, gained high-level administrative access to Silk Road, including the ability to manipulate logs. The full nature of the agents’ misconduct has not been disclosed as they pled guilty, resolving their cases without disclosure to the public. The agents ended up in prison, but they were never required to decrypt their Silk Road chat logs or turn over other materials such as laptops or email accounts that could have revealed the full extent of their involvement to shatter any further suspicions. For Ulbricht, his punishment has been labeled by many as exceedingly harsh, justified by prosecutors to serve as a deterrent for other cybercriminals.

Silk Road 2.0 sprang up barely a month after Ulbricht’s arrest as an attempted resurrection of the project. Soon thereafter, its administrators were also arrested. Since then, many other marketplaces have tried filling the demand for a darknet digital market. Agora, Hansa, AlphaBay are just a few of the major marketplaces that became popular in the following years. By 2019, none of them were operational, and their most well-known replacements, Dream Market and Wall Street Market, have languished under DDoS attacks.

Although many of the biggest marketplaces have been closed down, according to research done by blockchain analytics firm Chainalysis, Darknet market activity almost doubled throughout 2018, recovering from the 2017 slump. Their data show that Darknet activity is relatively immune to the price fluctuations of bitcoins, and surprisingly resilient in spite of aggressive efforts from law enforcement agencies. Even though such efforts yield partial success and result in shutdown of some marketplaces, their traffic is usually displaced to other markets.

Their data also show one very important trend often overlooked by the mainstream media and policymakers. Illicit transactions represent an increasingly smaller portion of overall Bitcoin activity. Their report suggests that in 2018, illicit activity with Bitcoin was less than 1%. According to the same report, a year later in 2019, even though the number grew slightly, it still oscillated around the same level. The numbers for 2020 suggested that number dropped to just 0.3%.

These low numbers stand in stark contrast with the popular narrative about digital currencies and illegal activities. Even in 2016, a team of researchers from various institutions published a paper demonstrating that Bitcoin commerce was no longer driven by the Darknet and trading of illicit items, but rather by legitimate enterprises, perhaps even as far back as 2013. While deep web marketplace activity has flourished and grown in the past few years, the Bitcoin ecosystem, volume, and user base have been growing at a much faster pace, rendering the illicit activities a negligible part of the Bitcoin world.

2013: The Adoption Boost

In 2013, Bitcoin investors experienced yet another extreme level of volatility. The exchanges Mt. Gox and BitInstant could not cope with demand and their servers became overwhelmed. By this time, Coinbase had already come online, but its popularity and volumes could not compete with the market leaders of the time. The Bitcoin market cap passed the $1 billion milestone before dropping dramatically.The price dropped in just three days from $259 to $45. But it was not just the price crash that the Bitcoin ecosystem had to deal with. In the US, the Financial Crimes Enforcement Network (FinCEN) classified bitcoin miners as money service businesses, and they became subject to capital gains taxes. Though this tax was only applied if they sold newly generated bitcoins for dollars on the market, it was not considered such when purchasing goods and services. Nonetheless, Bitcoin experienced a spike in popularity, and was soon followed by another historical event.

Throughout 2013, things in the Bitcoin world continued to move at a rather dynamic pace. The first Bitcoin ATM debuted in California. Vitalik Buterin proposed Ethereum, after failing to convince the Bitcoin community to develop a scripting language that would allow more advanced applications on top of Bitcoin. In October, the FBI seized almost 30,000 bitcoins after arresting Ross Ulbricht who was in charge of Silk Road. Yet, over the course of the next few weeks, the Bitcoin price rose to over $700 only to crash by over 50% in one day, and spiked at an all-time high of $1,160 in the next week. The spike, once again, was followed by a steep crash. Many at the time blamed the central bank of China because of their announcement prohibiting financial institutions in China to use bitcoins. The massive crash caused a phenomenon well known to the Bitcoin traders — FUD. Fear, uncertainty, and doubt. In the light of massive bitcoin sales on the market, a drunk and frustrated Bitcointalk user wrote his soon-to-be-legendary post with a typo in its header that elaborated on reasons to hold bitcoins even if the price crashes. Since then “HODL” has become a motto widely used across the cryptocurrency world.

By early 2014, Mt. Gox was experiencing a highly troubled period that would result in its demise. In February, the company’s internal slides were leaked and their content was a shock to its customers. The slides stated that the company was missing over 740,000 bitcoins, worth approximately $350 million at the time. Mt. Gox filed for bankruptcy in Japan in the next few weeks. More negative news came from China again. Amidst preparations for the Bitcoin Global Summit in Beijing, the Chinese authorities prohibited media outlets from covering the event. In addition to this, over the summer, one of the bitcoin mining pools, GHash.IO, exceeded the mystical 50% threshold of hash power. The community reacted rather quickly to this event, and within a year the pool's power dropped to roughly 2%.

While Bitcoin was experiencing difficulties, many new projects were introduced to the scene by a whole host of entrepreneurs. Overstock.com became the first major online retailer to embrace Bitcoin. Millions of dollars were poured into Bitcoin companies by venture capital firms. Jed McCaleb, founder of Mt.Gox and Ripple, launched his new brainchild named Stellar. Brock Pierce, with a few others, introduced Realcoin, which they claimed to be the first dollar-backed digital currency. Realcoin was later rebranded to Tether, a name that would be associated with plenty of controversy in the years to come. Monero, Dash, and “Chinese Ethereum” AntShares (later rebranded to NEO) were also launched in the same year.

Throughout 2015 and 2016, the former hegemonic role of Mt. Gox was lost to multiple exchanges. One of them was the Hong-Kong based company called Bitfinex. Despite the ongoing bear market in 2015 and legal troubles that dogged the company, it grew at a steady pace. But another disaster awaited bitcoin traders in the wings.In August 2016, Bitfinex suffered a massive security breach that resulted in the loss of 120,000 bitcoins. The hack, worth $72 million at the time, was followed by a price drop of almost 30% within a few hours. In an unpopular decision, the company decided to “share” the loss across the whole spectrum of its users, and reduced each user account by 36%. This included accounts that were not breached. Bitfinex subsequently issued tokens representing debt against the exchange to all users. The token was traded on the exchange and used the ticker BFX. Interestingly enough, the exchange repaid all its debt by spring 2017. Quite surprisingly after such an event, Bitfinex even managed to keep its market share.

By this time, cryptocurrency users had learned their lesson on private key security. The increasing popularity of hardware wallets like Trezor and Ledger would suggest that key management literacy of users increased as a result. But this problem would continue to be a major sticking point for everyday users of the cryptocurrency.By 2015, in spite of the ongoing bear market, BitPay reported that there are more than 100,000 merchants around the world accepting bitcoins. This number already included corporate giants such as Microsoft, Dell, Twitch, and many others. The end of the year marked the launch of the Hyperledger project by the Linux Foundation, funded by companies such as IBM, Intel, and SAP.

Parallel to the development of the Bitcoin ecosystem, an important debate over one of the most crucial protocol parameters — the block size — was heating up. One of the core developers, Mike Hearn, released Bitcoin XT as an alternative implementation with 8 MB blocks (instead of 1MB), which received support from a group of miners including F2Pool, BTCChina, Antpool, and Huobi. A significant portion of the nodes that ran the XT client were attacked throughout the year. The war against the larger blocks spilled over to Reddit threads as well, and the entire discussion turned hot-blooded. Reddit rates second after the “Twiterrati” in terms of being the most important source of information for the community, and it comes as no surprise that there are quite strong correlations between the Bitcoin Reddit mentions and its overall price. Nevertheless, as a result of the attacks and harsh rhetoric on block sizes, Hearn decided to quit his development activities and, in a lengthy post, declared Bitcoin a failed project.Shortly after his resignation, another proposal emerged that called for an increase in the size of blocks — Bitcoin Classic. In response to the proposal, an emergency Hong Kong roundtable meeting was held where a different protocol upgrade named Segwit, as well as 2 MB fork, was agreed upon by the key members of the community. The agreement lasted for a couple of months, especially when the Core developers decided to back up on the 2MB idea. Another proposal was born later in the form of Bitcoin Unlimited, which introduced the idea of block size adjustment based on miners’ preferences. The block size debate caused consternation, tension, and division in the community. We will cover it more into detail in the following chapters.

By summer 2015, Ethereum launched the mainnet that accelerated the upcoming trend of initial coin offerings that later took off in 2016. The most prominent and controversial, named The DAO, became one the largest crowd-funded projects in human history, raising almost 13 million ethers worth $150 million. It was a sizable decentralized fund created to finance projects from the Ethereum ecosystem. Shortly after its ICO, however, an attacker found a loophole in the underlying code and withdrew a significant portion of ethers. This led to a dramatic price dip of Ether, and the network eventually was forced to undergo a hard fork that gave birth to Ethereum Classic.At the same time, an infamous aggressive referral system similar to MLM called Bitconnect also launched. The company promised a high-yield investment program and managed to lure hundreds of thousands of investors. In a few months, it became one of the leading coins in terms of the market cap and received attention not just from the media, but regulators as well. Official notices indicated what was clear to many in the space — Bitconnect was one of the largest Ponzi schemes in the history of digital currencies. This was confirmed in early 2018, when the company closed down, resulting in a dramatic decline in the price of their coin.

During 2016, the Bitcoin hashrate accelerated at the fastest rate since the launch of the network, growing roughly 200%. Along with that, network traffic grew exponentially, as the average number of transactions increased about 50% per second. Full blocks appeared more often throughout the year, and the size of the blockchain doubled. Furthermore, the size of the unspent transaction outputs (UTXO) set also grew, suggesting the distribution of bitcoin ownership to a wider user base.

2017: Boom and Bust, Modern Era

The year 2017 was a period of unprecedented frenzy. Wikipedia's annual “Top 50 Report” revealed that Bitcoin was the ninth most-read article on the digital encyclopedia, gaining more views than Elon Musk or Dwayne “the Rock” Johnson. The total market capitalization of the cryptocurrency market exploded from $18 billion to a peak of $664 billion. Hundreds of ICOs popped up, and for many startups it was an easy way to raise funds by issuing their own coin — no matter its utility. This allowed them to raise money without having to use traditional venture capital. The Bitcoin price sailed past its previous high mark of $1,000, and shot up to nearly $20,000 by the end of the year. Even though Bitcoin dominance shrank from 80% to 35% throughout the year, an estimated $12,000 per second was transacted on the Bitcoin network. This was a major shift from just $2,000 per second in 2016.

The optimistic market sentiment was strengthened by new laws passed in Japan that recognized bitcoins as legal tender. Exchanges like Poloniex, Bittrex, Kraken and others experienced a massive increase in their user bases, leading some to temporarily decline new customers for some time. New exchanges emerged to serve the hungry crowds. Binance was one of them. In a matter of just a few months, it raised $15 million and became the number one crypto exchange in the world by volume.

Amidst the spiking hysteria around cryptocurrencies by the general public, developers continued to fight over the “right” size of the bitcoin block. Another roundtable was convened, this time in New York, and resulted in a deal codenamed SegWit2x. The deal outlined the plan to implement a protocol upgrade — Segregated Witness — to provide protection against transaction malleability, followed by the eventual doubling of block size.On August 1, 2017 Bitcoin split as the majority of the network implemented SegWit, while a minor part of the network introduced 8 MB blocks while skipping SegWit. This effectively created two separate networks of nodes running different code, enforcing different rules. From this point onward, we call the former Bitcoin, and the latter Bitcoin Cash. The fork became one of the most controversial events in Bitcoin history. Even though over 80% of miners signaled their intention to support SegWit2X, the “2x” part of the deal eventually failed to gain support from the community and Core developers. Nonetheless, the event kicked off dozens of other Bitcoin forks such as Bitcoin Gold and Bitcoin Diamond, whereas the vast majority of them did not gain widespread adoption.

By this time, the word blockchain had become the holy grail of buzzwords, and increasingly more corporations channeled their attention to its utilization. “Blockchain, not Bitcoin'' was the motto. Transparency, decentralization, and immutability were the main purported benefits of solutions based on it. In reality, the real benefits of most of the blockchain-inspired solutions adjusted to operate in an enterprise environment have been questioned by many in the cryptocurrency space. Having a robust, open, decentralized, trust-minimizing, and censorship-resistant network stripped down to a dozen nodes in a walled garden looked more like smoke with no fire.

During this time, several philosophical questions arose. How many connected ledgers (or organizations) does it take to call the system a blockchain? Is two enough? How distributed must a network be to be considered decentralized? Or, what is the most essential substance of the blockchain? Its decentralization, the Proof-of-Work consensus mechanism, or the particular data structure of chained blocks? If all of those, is the system possessing just two of three components just a slow and inefficient database? Anyone trying to answer these questions is guaranteed to be ridiculed either by the cryptocurrency OGs, or the enterprise blockchain architects. As Nick Carter famously summed it up in his article, “Blockchain is a Semantic Wasteland,” pointing out to the degree to which the term “blockchain” is semantically so dispersed that it has become undefinable:

"Blockchain" dilutes the importance of a tremendously important and valuable innovation — a trust-minimized monetary system — and abases it by putting it to work to generate efficiencies, real or imagined, in enterprise supply chain management.

Nevertheless, blockchain consortia formed, and among them the most prominent: The Ethereum Enterprise Alliance. It brought together banks, accounting firms, consulting firms, and mainstream companies such as Microsoft, JP Morgan, ING, Intel, UBS, Santander and Samsung. Cryptocurrencies were gaining credibility and bitcoin symbol was even encoded in Unicode version 10.0 at position U+20BF (₿) in the Currency Symbols block. Despite the rejected proposal of the Winklevoss brothers that called for creation of a Bitcoin ETF (exchange traded fund), Bitcoin was on the path to become an asset not just for geeks. This was underlined by announcements to launch Bitcoin Futures by both CBOE and CME. While the former eventually ceased its offering, the latter went on to offer options on Bitcoin futures.

After the period of accelerating growth of the user base as well as price, 2018 began with a steep price drop across the whole cryptocurrency market. Soon, the vast majority of the overhyped altcoins from the previous year were washed out and their market prices and liquidity evaporated significantly. Consolidation on the market helped the entire ecosystem. Despite much lower volumes, some exchanges were succeeding. BitMEX was one of the exchanges that experienced a spike in popularity. While they were not the only ones to offer leverage trading, they offered the highest leverage of 100x as well as some exotic products like perpetual swaps. Derivatives became increasingly popular across different cryptocurrency exchange platforms like Deribit and Binance. The latter company introduced the opportunity to trade futures with 125x leverage by 2019. Progress and adjustments were made also on the Bitcoin protocol itself, as well as on the upper layers such as Lightning Network and RSK that moved to mainnet. We will cover these solutions in the next chapter.

With falling prices, Bitcoin caught the attention of the mainstream media, for a change, for its technological properties. More specifically, this spike in media coverage concerned the ability to attach random chunks of data to a Bitcoin transaction. A group of researchers at Aachen University and Goethe University identified that the option to load an arbitrary amount of data into the Bitcoin blockchain had resulted in over 1600 uploaded files. The study found that 59 of them included links to illegal pornography and other sensitive content. Nonetheless, Bitcoin data anchoring marked a significant increase, as can be seen with the Omni protocol, one of the most popular tools for this purpose.

In 2019, as the Bitcoin price marked slow but steady growth, significant progress was made on different fronts. In the case of Lightning Network, this was true not only on the protocol level, but also in its usability, owing to the emergence of plug-n-play nodes such as Casa. They allowed users to run their own Bitcoin and Lightning node in an easy and very user-friendly fashion.A lot of work was completed on proposals related to the Bitcoin protocol itself, and Bitcoin also significantly expanded on its data anchor usage, allowing other systems to utilize it as a trust anchor to increase the level of security and immutability of their data. While there are a number of tools for this particular utilization of the Bitcoin blockchain, Veriblock’s “Proof-of-Proof” is the leading one. However, the design of the system suggests that we can expect this to be done increasingly via side chains such as RSK or Liquid, in the future.

But it wasn't just the protocol infrastructure that further developed. The market and investment environment also matured. In this field, the top milestone of the year was the launch of regulated physically-settled futures contracts in the United States, via Bakkt, in September. Compared to CME’s cash-settled futures, physical delivery makes the price determination less vulnerable to manipulation. The competition did not wait long and a similar product was introduced by ErisX at the end of the year. An interesting trend was spotted in the report released on self-directed brokerage accounts (SBDAs) within retirement plans by Charles Schwab Corp. The report showed that millennials favored holding Bitcoin over many of the high-profile company stocks such as Netflix, Microsoft, Walt Disney and others. Grayscale Bitcoin Trust BTC (GBTC) from Grayscale Investments was the fifth-largest holding in millennial accounts after Amazon, Apple, Tesla, and Facebook stocks. This represented 1.84% of assets held in equities. Unsurprisingly, Bitcoin did not make it in the Top 10 assets held by older generations, but these numbers likely reveal what the future holds for Bitcoin in terms of investment trends.

November 2019 marked a new all-time high in the Bitcoin hashrate, reaching over 110 million TH/s. At this time, the mining industry had been experiencing a large inflow of capital, especially in the US, in hopes of wrestling away market share from Chinese mining operations. This trend was welcomed by the community, especially because of the ever-present concerns related to mining operations being centralized, predominantly in China. This issue may be, however, tackled from a different angle. A proposed mining protocol improvement — BetterHash — was drafted by Bitcoin Core developer Matt Corallo. It allows pool miners to regain control over their hashpower. As too much centralization is the status quo when it comes to mining has been an omnipresent concern in the Bitcoin space, this is certainly an important step.

Along with protocol and market infrastructure, gigantic steps were taken in driving retail commerce. On one side, merchants made it easier to accept cryptocurrencies via services such as Cash App and Spedn, created by financial technology companies Square and Flexa. Square also launched an initiative to support open-source development of Bitcoin and Lightning infrastructure to help facilitate widespread user adoption. Square’s efforts to support Bitcoin are driven by its CEO Jack Dorsey, who also invested in Lightning Labs, the company behind one of the implementations of Lightning Network, and who is also the CEO of Twitter. This fact may suggest an interesting possibility of convergent development in the future.

On the other hand, where merchants do not accept cryptocurrencies, there are several emerging tools for crypto holders. The 2017 hype brought forth a hoard of companies issuing prepaid debit cards that allowed their customers to top up via cryptocurrencies. Responding to the backlash from regulators and the wider banking industry, many were forced to close, restrict their areas of service, and relaunch with appropriate licensing. By 2020, most of these companies did not operate in the US. A few operated in Europe, such as Bitwala or Wirex, and most of them in Asia.

The Bitcoin infrastructure has evolved significantly on all fronts in the past few years. The number of merchants rose, as well as the number of tools and applications for cryptocurrency users. The market infrastructure is becoming more mature, the protocol is evolving to better scale, provide lower transaction fees, and higher levels of privacy. Awareness is also on the rise, as about eight in ten Americans are familiar with at least one type of cryptocurrency, and the r/bitcoin subreddit boasts with almost 2.9 million subscribers. Illicit transactions made up just a tiny fraction of around 1% of all cryptocurrency activity, and the majority of the world’s top universities offer at least one course on cryptocurrencies and blockchain.

In the year 2020, the spread of a global pandemic rocked the world as well as financial markets. When the pandemic became “official”, markets crashed across the world. As the globe stopped spinning for some time, and with most of the commercial activity curtailed, political elites responded with fiscal stimulus in order to mitigate the impact of the pandemic. Trillions of dollars were pumped into the economy to fight the crisis. According to many estimations, in 2020 alone, the USA created 22% of all the USD issued in its history. This number made increasingly more investors concerned about the potential inflationary pressures. As some companies, led by publicly traded MicroStrategy, began moving their cash reserves into Bitcoin, instead of dollars, the demand for Bitcoin picked up and accelerated the bull market. As Bitcoin found way to more and more company treasuries, the Decentralized Finance space experienced unprecedented growth on its own. Total value locked (TVL) in DeFi climbed from below $1 billion in January 2020 to almost $50 billion a year later, and Uniswap, the leading decentralized exchange, could compete on trading volumes to well-known cryptocurrency exchanges. The amount of tokenized dollars as well as bitcoins on Ethereum, grew many fold. And, finally, Ethereum introduced the long-awaited phase 0 of its transition to ETH 2.0 while launching staking in December 2020. As the world made a huge leap forward in digital transformation, spearheaded by Covid-19, the proposition and importance of cryptocurrencies has become clear. Cryptocurrencies are eating the world and there are many reasons to think they will continue to do so in the future.